Statement of the Chairman

of the Board of Directors

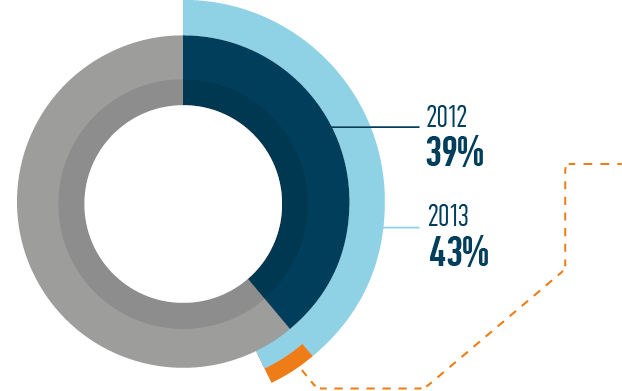

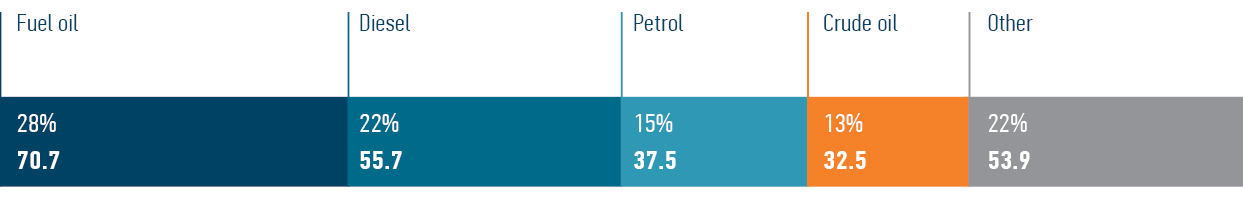

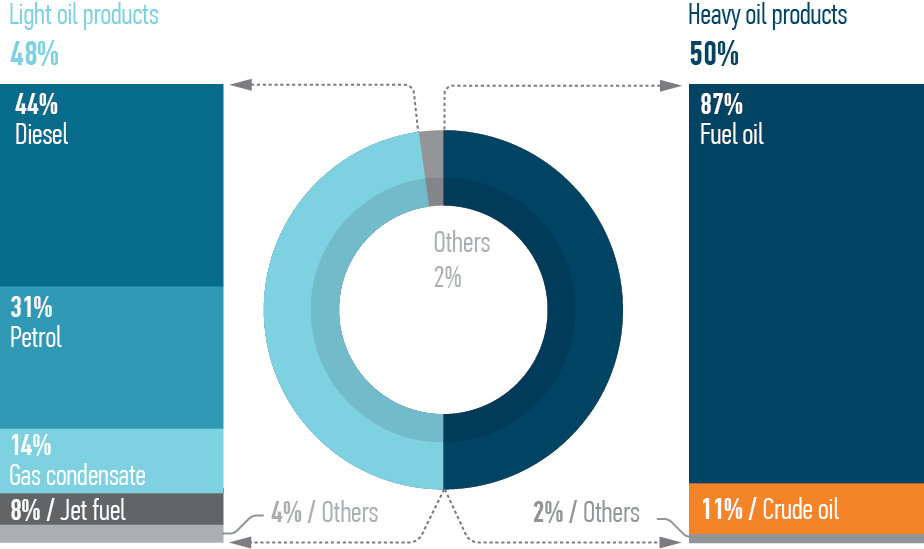

We have been constructing a solid platform for achieving key targets throughout the past decade, since Transoil was launched. The jubilee year 2013 confirmed the appropriateness of the chosen business model and fully demonstrated the fundamental advantages of the Group. Having achieved strong operational results in complicated economic conditions, Transoil strengthened its leadership in the oil and petroleum products rail freight segment within the 1520 Space.

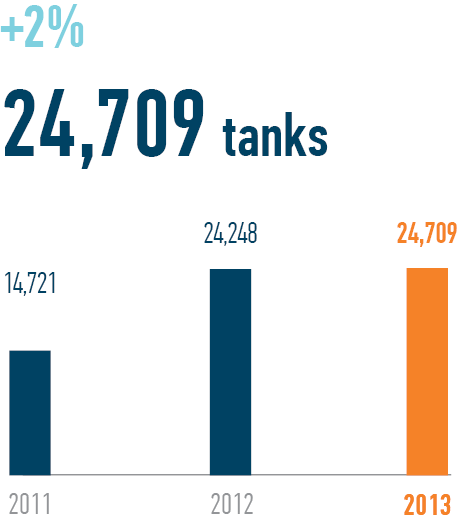

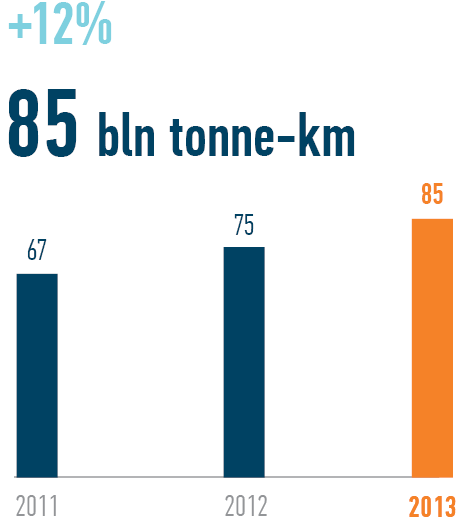

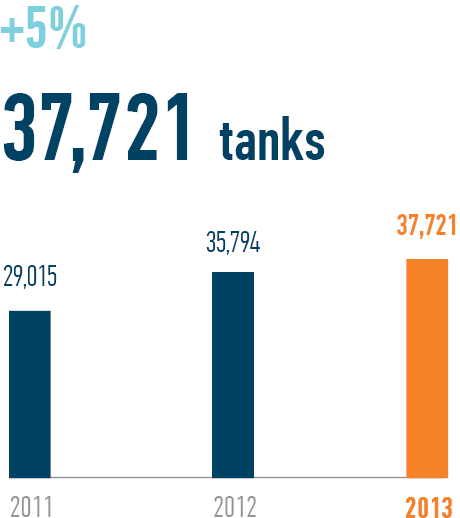

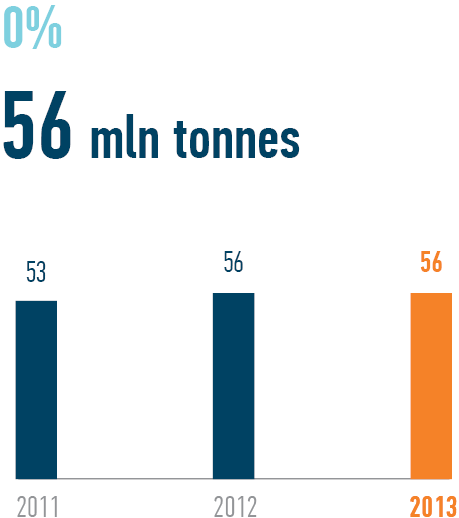

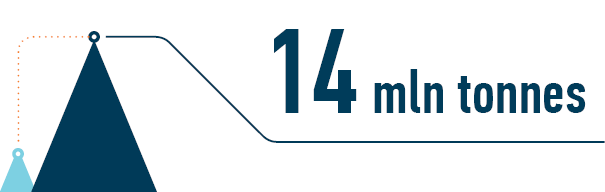

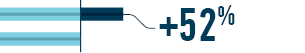

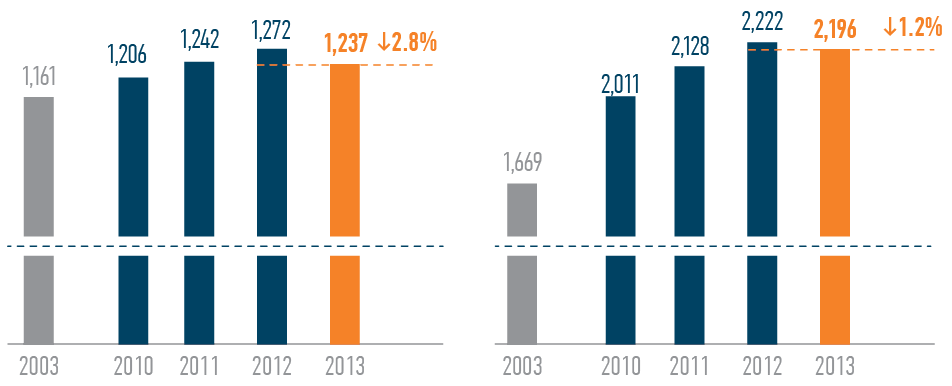

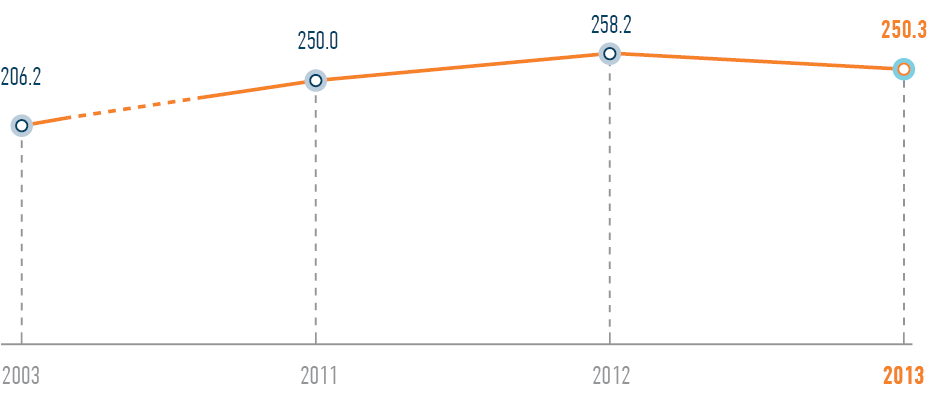

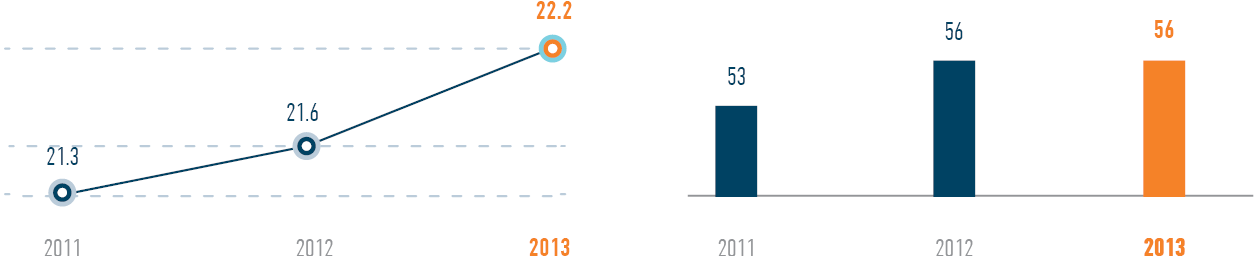

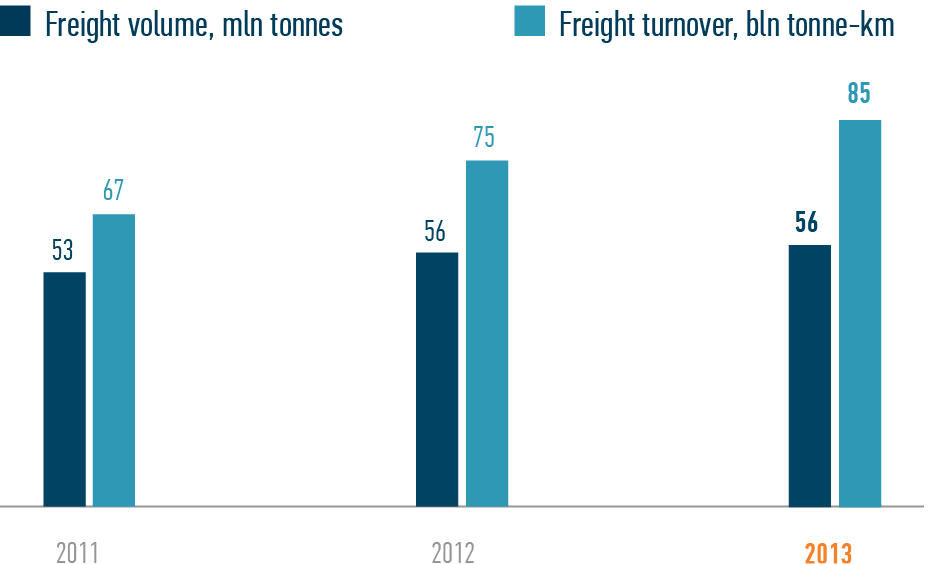

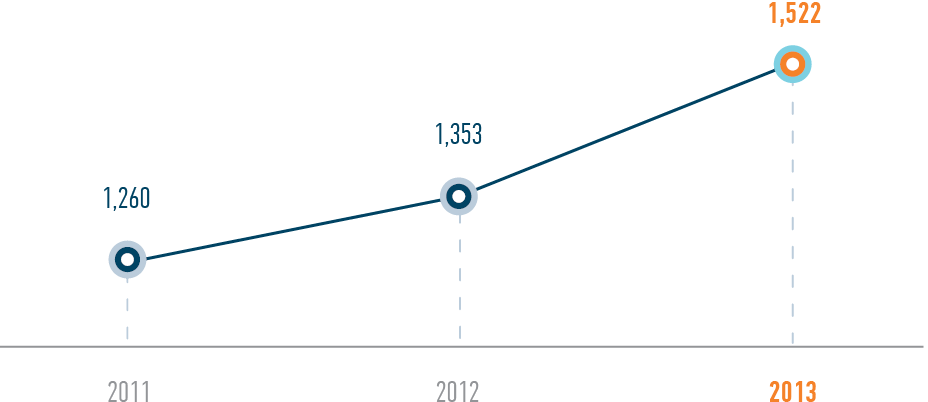

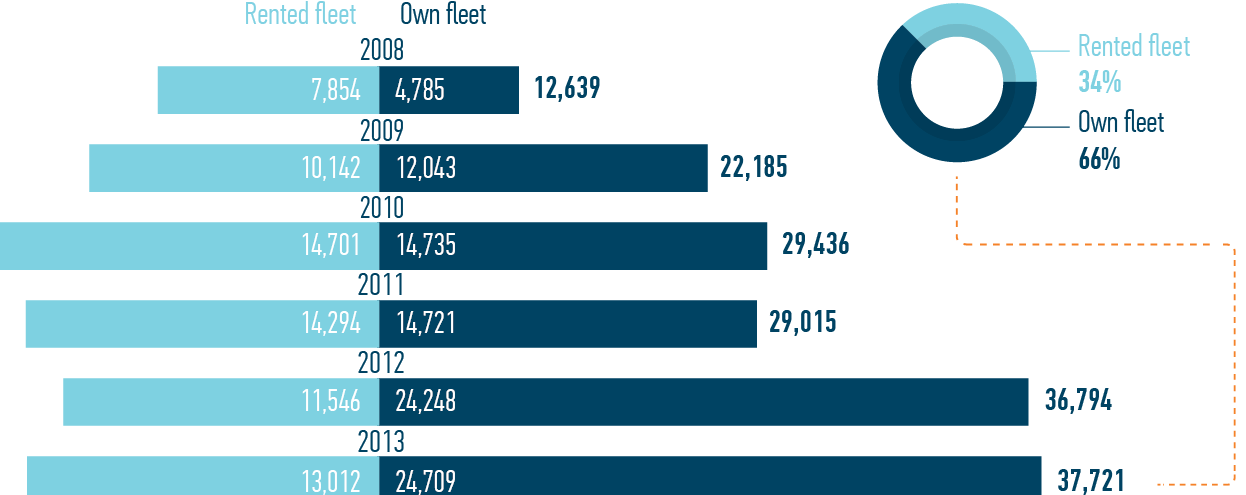

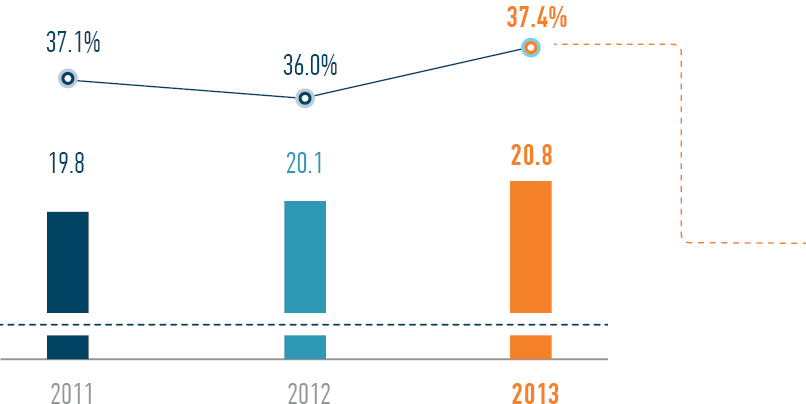

As of year-end, each tank in operation carried 1,472 tonnes of freight, that surpasses the average market rate by more than half, our freight volume in physical terms amounted approximately to 56 mln tonnes and freight turnover increased by 12.4% – up to 84.6 bln tonne-km.

Despite a deterioration in market conditions and the development of restrictive system factors, we managed to achieve record financial performance due to returns from program projects in the sphere of a logistic scheme to improve use of rolling stock, to enhance operational sustainability and optimize cost. Changes in the key business metrics of Transoil’s activities have been recognized by Moody’s Investors Service: the Group’s corporate credit rating outlook was changed to “positive”. Such an evaluation of our financial and operational successes proves that Transoil is a first-class borrower that occupies strong position within the industry, pursues well-balanced financial policy and reliable risk management methods.

Having crossed the decade mark, Transoil started a large-scale implementation of projects in the sphere of business corporate social responsibility. The portfolio of initiatives included in the Group’s CSR concept has successfully passed the stage of establishment. In 2013, we launched a corporate volunteering system, started two flagship programs with the Non-commercial Organization “Russian Aid Fund” (Rusfond), and carried out preparatory research within the framework of the environmental project “Green Filling”. Furthermore, we improved processes aimed at creating favorable conditions for the self-fulfillment and professional development of employees. Further details on the Transoil’s role in public life are available in the section “Sustainable development policy” of this Report.

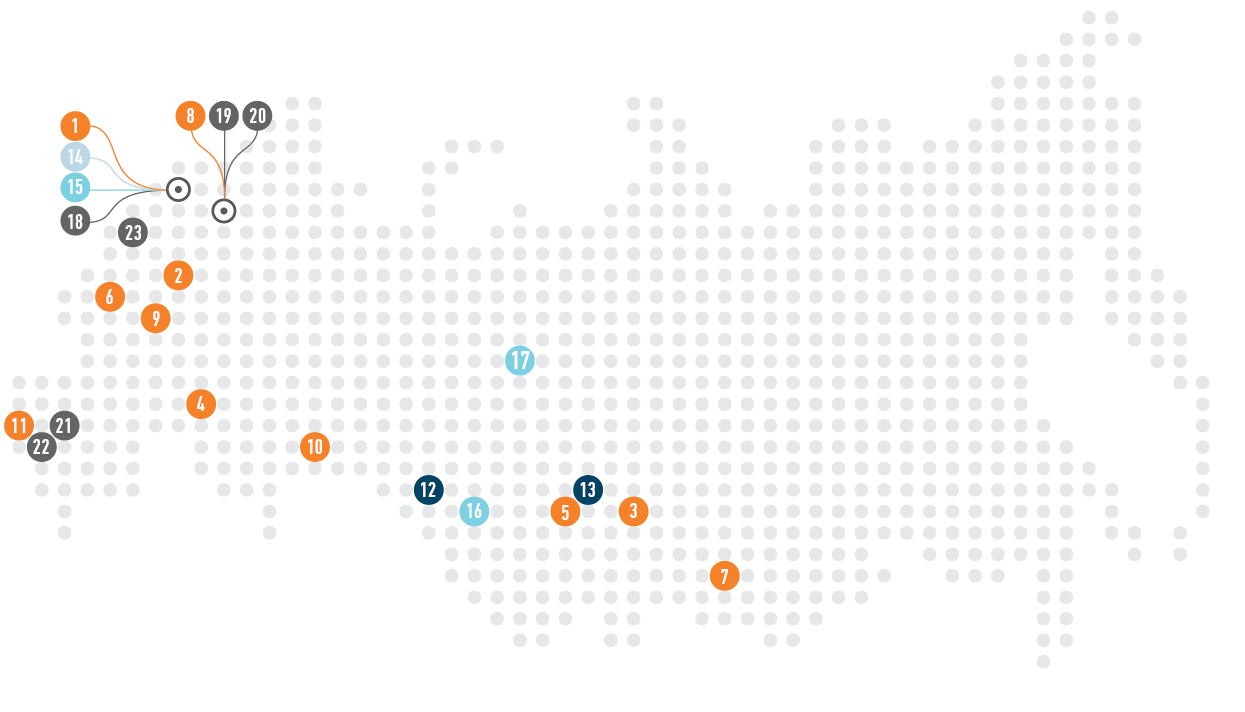

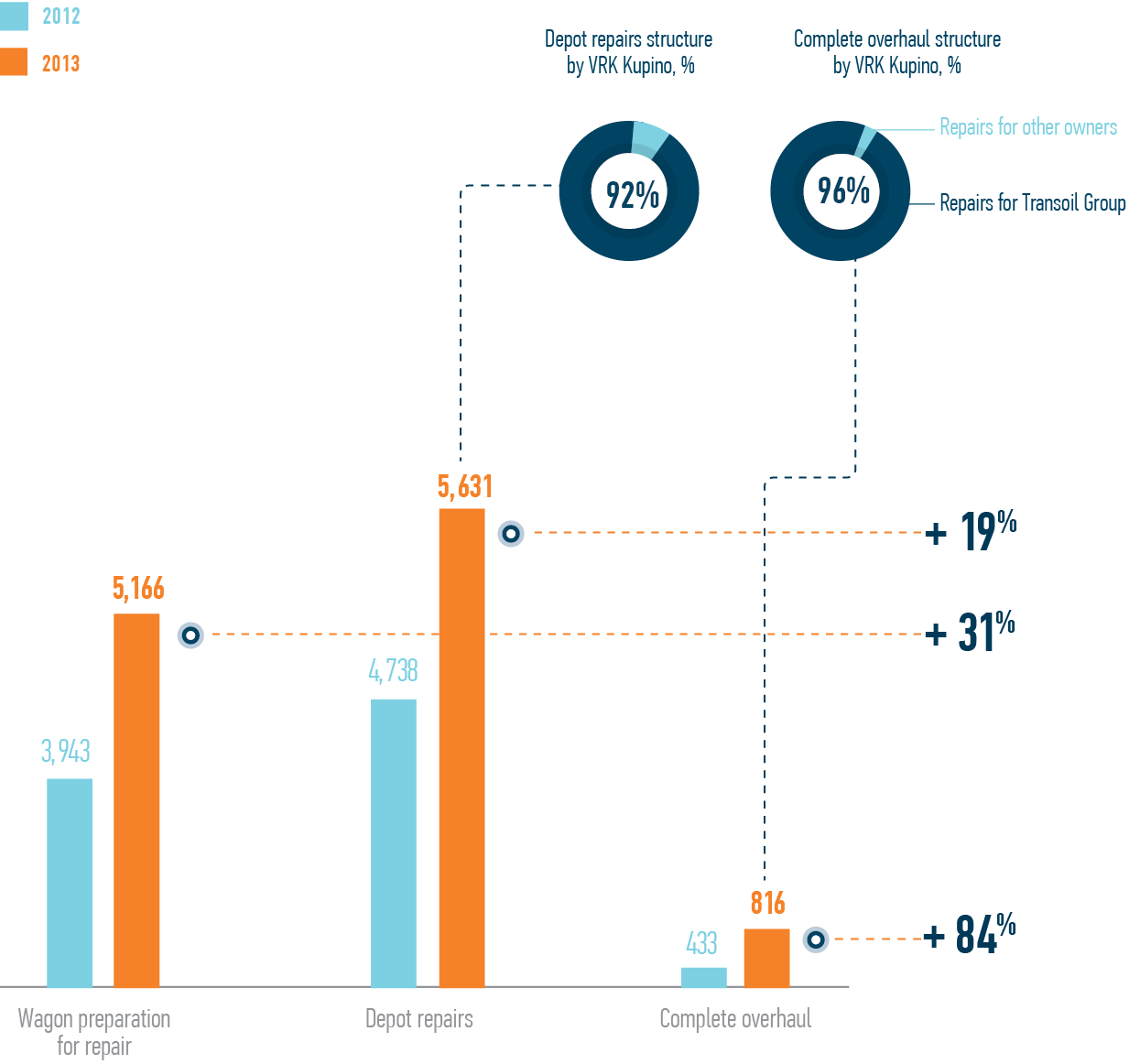

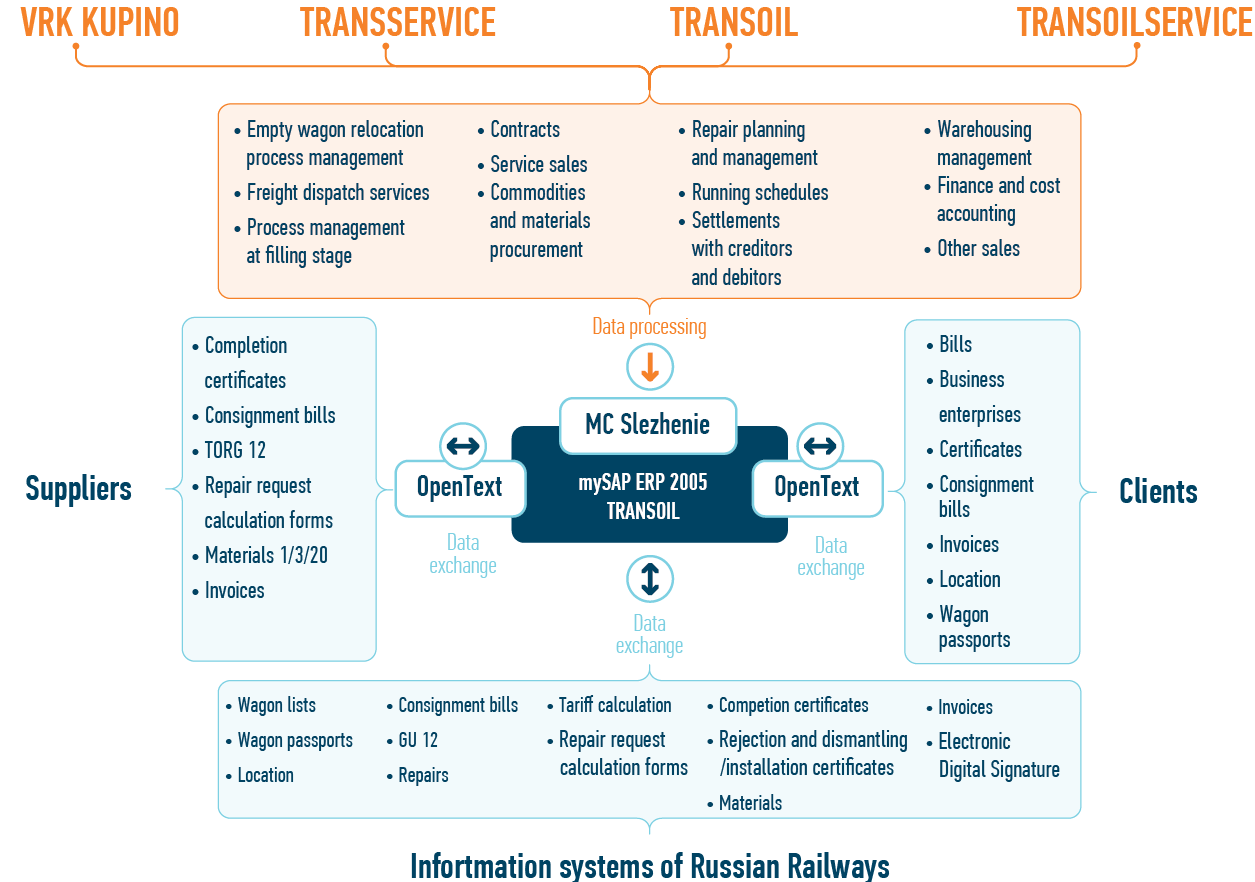

During the year, we have been focusing on business process efficiency improvement and service production cost control, the modeling of integrated proposals, and expanding capacity of auxiliary divisions through broadening the geographic footprint. This is aimed not only at creating opportunities for meeting the changing demands of our customers, but also at increasing the share of services with high added value in our portfolio. Along with a prevailing position in a historically stable and prospective segment, these factors will allow us creating optimal conditions for providing maximum benefit for shareholders.

We are careful in assessing forecasts with respect to market dynamics while noting the instability of economy and the remaining excess rolling stock in the Russian Railways’ network in Q1 2014. Nevertheless, following the results of analysis of recent policy documents of the Government of the Russian Federation with respect to the national oil industry and the Russian Railways’ forecasts on petroleum products transportation volumes, we expect that the rail oil and petroleum products rail freight segment will retain its attractiveness in the mid-term. At the same time, I am confident that the Group, having an efficient strategy aimed at share expansion in its core segment, will properly overcome the system crisis.

On behalf of the Board of Directors, I promise that we will support the Transoil team and assist it in attaining our ambitious goals.